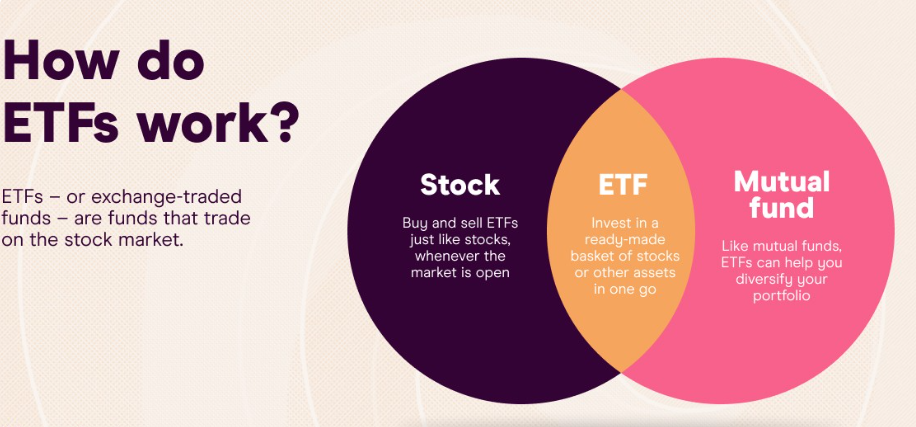

An Exchange-Traded Fund (ETF) is a type of investment fund that combines the features of a mutual fund and a stock. It pools money from multiple investors to buy a diversified portfolio of assets, such as stocks, bonds, commodities, or real estate investment trusts (REITs). ETFs offer diversification and lower costs by investing in a basket of different investments, while individual stocks provide ownership in a single company with the potential for higher returns but also higher risk and volatility.

Access exclusive content on the moneymortal platform and stay informed with valuable updates.

What is ETF’s in simple terms

Exchange-Traded Funds (ETFs) are a type of investment that combines the features of a mutual fund and a stock. Think of it like a big basket that holds a bunch of different investments, such as stocks, bonds, or commodities. When you buy shares of an ETF, you’re actually buying a small piece of that basket, which gives you exposure to all the investments inside it.

ETFs are created and managed by financial institutions or fund companies. These entities buy a collection of assets, like stocks or bonds, to form the underlying portfolio of the ETF. They then divide the ownership of this portfolio into shares. These shares are what investors buy and sell on stock exchanges. One of the key benefits of ETFs is diversification. Since an ETF typically holds a basket of different assets, investors get exposure to a variety of investments with just one purchase. This helps spread out risk because if one investment in the ETF performs poorly, there are others that might perform better.

ETFs are traded on stock exchanges throughout the trading day, providing liquidity and flexibility. Investors can buy and sell ETF shares easily at market prices, just like they would buy individual stocks. This makes it convenient for investors to get in and out of their investments.

ETFs also often have lower fees compared to actively managed mutual funds. This is because many ETFs passively track a specific index, like the S&P 500, rather than relying on expensive fund managers to actively pick investments. Lower fees mean investors get to keep more of their investment returns over the long term.

Key Takeaways

- ETFs are investment funds that trade on stock exchanges.

- They offer diversification, low cost, and ease of trading.

- ETFs are managed by financial institutions and hold a diversified portfolio of assets.

- ETFs allow you to invest in a bunch of different things at once. This helps spread out risk because if one investment doesn’t do well, there are others that might perform better.

Here’s how it works:

Creation of ETFs:

- Financial institutions or fund companies create ETFs by buying a bunch of different investments, like stocks or bonds.

- They then divide the ownership of these investments into shares, just like how a pizza can be cut into slices.

- These shares represent ownership in the ETF, and investors can buy and sell them on the stock exchange.

Trading ETF Shares:

- Once an ETF is created, its shares are listed on stock exchanges, similar to how items are displayed in a store.

- Investors can buy and sell these shares throughout the trading day, just like buying or selling items in a store.

- The prices of ETF shares go up and down based on how many people want to buy or sell them

Diversification in ETFs:

- ETFs often hold a mix of different investments, like a bag of assorted candies.

- This mix helps spread out risk because if one type of candy goes bad, there are still other candies that are good to eat.

- Similarly, if one investment in an ETF doesn’t do well, there are other investments that might perform better, helping to balance things out.

Low Costs of ETFs:

- ETFs usually have lower fees compared to some other types of investments.

- This is because they often track a specific group of investments, rather than having someone actively choosing each ingredient, which can be more expensive.

- Lower fees mean investors get to keep more of their money.

Why should I invest in ETFs?

- Diversification: Imagine you’re putting all your eggs in one basket. If something happens to that basket, you lose all your eggs. But with ETFs, it’s like having lots of baskets with different things in each one. If something bad happens to one basket, you still have lots of others that are safe. ETFs invest in many different things, like stocks, bonds, or commodities, so if one investment doesn’t do well, there are others that might perform better. This helps spread out your risk and makes your investment safer.

- Low Costs: When you invest in something, you usually have to pay fees. These fees can eat away at your profits over time. But ETFs usually have lower fees compared to other types of investments, like mutual funds. This means you get to keep more of your money, which can add up to a lot over time. It’s like getting a discount on something you buy – you get the same thing but pay less for it.

- Easy Trading: Investing in ETFs is as easy as buying a book online. You don’t need to go through a complicated process or talk to anyone. You can buy and sell ETFs anytime you want, just like you would buy something from a store. This makes it convenient for you to manage your investments and react quickly to changes in the market.

- Flexibility: ETFs come in many different varieties, like different flavors of ice cream. You can choose ETFs that invest in specific industries, regions, or even strategies. This gives you lots of options to pick from based on what you’re interested in or what you think will do well in the future. It’s like being able to customize your investment portfolio to fit your preferences and goals.

- Tax Efficiency: Nobody likes paying taxes, but with ETFs, you might be able to pay less. ETFs are designed in a way that can be more tax-efficient compared to other types of investments. This means you might have to pay fewer taxes on your investment gains, leaving you with more money in your pocket. It’s like getting to keep more of the money you make.

Advantage and Disadvantage of ETF’s

| Advantages | Disadvantages |

|---|---|

| Diversification: ETFs offer a way to invest in a bunch of different things at once, reducing risk because if one investment doesn’t do well, there are others that might perform better. | Market Risk: Like any investment, ETFs are subject to market risk. If the overall market declines, the value of an ETF can also decrease, regardless of the quality of the underlying assets. |

| Low Costs: ETFs typically have lower fees compared to other investment options, which means investors get to keep more of their money. | Tracking Error: Some ETFs may not perfectly track their underlying index or assets due to factors such as fees, trading costs, or imperfect replication methods. |

| Easy Trading: ETFs are traded on stock exchanges like individual stocks, making it convenient for investors to buy and sell them. | Overtrading: The ease of trading ETFs can sometimes lead to overtrading, where investors buy and sell frequently, potentially incurring higher transaction costs and taxes. |

| Flexibility: There are many different types of ETFs available, covering various industries, regions, or investment strategies, providing investors with lots of options to choose from. | Limited Control: ETF investors don’t have direct control over the individual investments held within the ETF. This means they can’t make specific changes to the portfolio to align with their personal preferences or beliefs. |

| Tax Efficiency: ETFs are usually more tax-efficient compared to other investment options, potentially resulting in lower taxes on investment gains. | Liquidity Risk: While ETFs are generally liquid investments, there may be instances where liquidity becomes a concern, especially for less popular or niche ETFs, which can lead to difficulty buying or selling shares at desired prices. |

Different Types of ETF’s

- Stock ETFs: These ETFs invest in a bunch of different stocks. It’s like buying a mixed bag of candies, but instead of candies, you’re buying pieces of different companies. Stock ETFs can focus on specific sectors (like technology or healthcare) or include a broad range of companies from different industries.

- Bond ETFs: Bond ETFs invest in bonds, which are like loans you give to companies or governments. When you buy a bond ETF, you’re lending money to lots of different borrowers. Bond ETFs can include government bonds, corporate bonds, or bonds from different countries with varying levels of risk and return.

- Commodity ETFs: These ETFs invest in physical commodities like gold, silver, oil, or agricultural products. It’s like owning a small piece of a gold bar or a barrel of oil. Commodity ETFs can track the price of a specific commodity or a basket of commodities, allowing investors to gain exposure to commodity markets without owning the physical assets.

- Sector ETFs: Sector ETFs focus on specific sectors of the economy, such as technology, healthcare, or energy. It’s like investing in a specific area of interest, such as technology companies like Apple or Microsoft. Sector ETFs can help investors target their investments in industries they believe will perform well in the future.

- International ETFs: These ETFs invest in companies or assets outside of your home country. It’s like expanding your investment horizon beyond your own backyard to include companies from different countries around the world. International ETFs can provide diversification and exposure to global markets.

- Style ETFs: Style ETFs invest based on specific investment styles, such as growth or value investing. Growth ETFs focus on companies with high potential for growth, while value ETFs look for undervalued companies with strong fundamentals. Style ETFs allow investors to align their investments with their preferred investment strategy.

- Dividend ETFs: Dividend ETFs invest in companies that pay dividends, which are like rewards or bonuses that companies give to their shareholders. It’s like receiving a portion of the company’s profits for owning its stock. Dividend ETFs can provide a steady stream of income for investors seeking regular dividend payments.

How to Buy ETFs

- Choose a Broker: First, you need to open an account with a brokerage firm. This is like opening a bank account but for buying and selling investments like stocks and ETFs. You can choose an online brokerage firm or a traditional brokerage firm with a physical location.

- Research: Before you buy an ETF, it’s a good idea to do some research. Think about what kind of investments you want to make. Do you want to invest in stocks, bonds, commodities, or a specific sector? Look into different ETFs that match your investment goals.

- Place an Order: Once you’ve decided which ETF you want to buy, you can place an order through your brokerage account. This is like telling the brokerage firm that you want to buy a certain number of shares of a specific ETF. You’ll need to specify the ticker symbol of the ETF and the number of shares you want to purchase.

- Set Price: You can either place a market order, where you buy the ETF at the current market price, or a limit order, where you specify the maximum price you’re willing to pay for the ETF. If the ETF’s price reaches your limit, the brokerage will execute the order.

- Confirm and Pay: After placing your order, review the details to make sure everything is correct. Once you’re satisfied, confirm the order. If you’re using a market order, the ETF shares will be purchased immediately at the current market price. If you’re using a limit order, the purchase will be made when the ETF’s price reaches your specified limit.

- Monitor Your Investment: After buying the ETF, you can monitor its performance through your brokerage account. You can track how the ETF’s price changes over time and decide whether to hold onto it for the long term or sell it if you want to.

Conclusion

In simple terms, Exchange-Traded Funds (ETFs) are a smart and easy way to invest your money. They’re like a mixed bag of investments, giving you a piece of many different things at once. One of the best things about ETFs is that they help spread out your risk – if one investment doesn’t do well, there are others that might perform better. Another great thing about ETFs is that they usually have lower fees compared to other investment options. This means you get to keep more of your money instead of paying it in fees. Plus, you can buy and sell ETFs just like you would buy things from a store, making it really convenient and flexible.

ETFs offer a simple and cost-effective way to grow your money over time. They’re a bit like a magic bag that holds a mix of investments, helping you stay safer while potentially making money. So if you’re thinking about investing, ETFs could be a great option to consider.

FAQ’s

What exactly is an ETF?

An Exchange-Traded Fund (ETF) is a type of investment fund that holds a collection of assets, such as stocks, bonds, or commodities. It’s like a big basket that holds a bunch of different investments, and when you buy shares of an ETF, you’re buying a small piece of that basket.

How do I buy and sell ETFs?

Buying and selling ETFs is similar to trading individual stocks. You can buy ETF shares through a brokerage account, either online or through a traditional brokerage firm. Once you’ve opened an account, you can search for the ETF you want to buy and place an order through your brokerage platform. Selling ETF shares works the same way – you place an order to sell your shares through your brokerage account.

How are ETFs different from mutual funds?

ETFs and mutual funds are both types of investment funds, but they have some key differences. While mutual funds are bought and sold directly through the fund company at the end of the trading day, ETFs are traded on stock exchanges throughout the trading day, just like individual stocks. Additionally, ETFs often have lower expense ratios compared to mutual funds, and they may offer more tax efficiency due to their structure and trading mechanism.